Identifying customer needs to find Product Market Fit

Case Study – UX UI Design / Conta Simples

Author: Leandro de Andrade

UX / UI Designer: Leandro de Andrade

UX Research: Leandro de Andrade

Project: Rodrigo Tognini, Fernando Santos, Ricardo Gottschalk

About the project —

About the project

When I co-founded Conta Simples, at the beginning of 2019, together with Rodrigo Tognini, Fernando Santos, and Ricardo Gottschalk, we received many recommendations from angel investors that we needed to niche the company and not simply be a “PJ Digital Account” in order to be able to scale and Have a strong value proposition.

Teams and functions

As we were in an early stage, we only had 3 collaborators helping us to build the product (devs). In this way, I was responsible with the partners in validating the value proposition of the Simple Account.

Context —

Before starting, it is worth giving a little context to understand the problem more in-depth.

We didn’t have enough capital (money) to fight in the market as a digital account for companies. This happens because we are entering a very competitive and capitalized market.

The initial value proposal was a digital account for companies with no annual fee, with immediate account opening, with a corporate prepaid credit card, and with a daily income from the account balance with 100% of the CDI.

The problem —

Understanding the Problem and Process

What was done to find a solution to the problem;

We knew that competing with the big banks and startups would be a game we couldn’t win. And the product “Conta Digital PJ” has always been seen as a commodity, this definition is used for a product that becomes massified and not differentiated for our customers.

After all, every customer who uses a digital account wants to receive and send money (Cash-in and Cash-out).

And when you’re building a startup, you’re looking for the blue ocean, that is, differentiation to gain market share and growth.

To understand the problem, we first devised a strategy to understand how our first customers related to our account (behavior).

Pesquisa quantitativa —

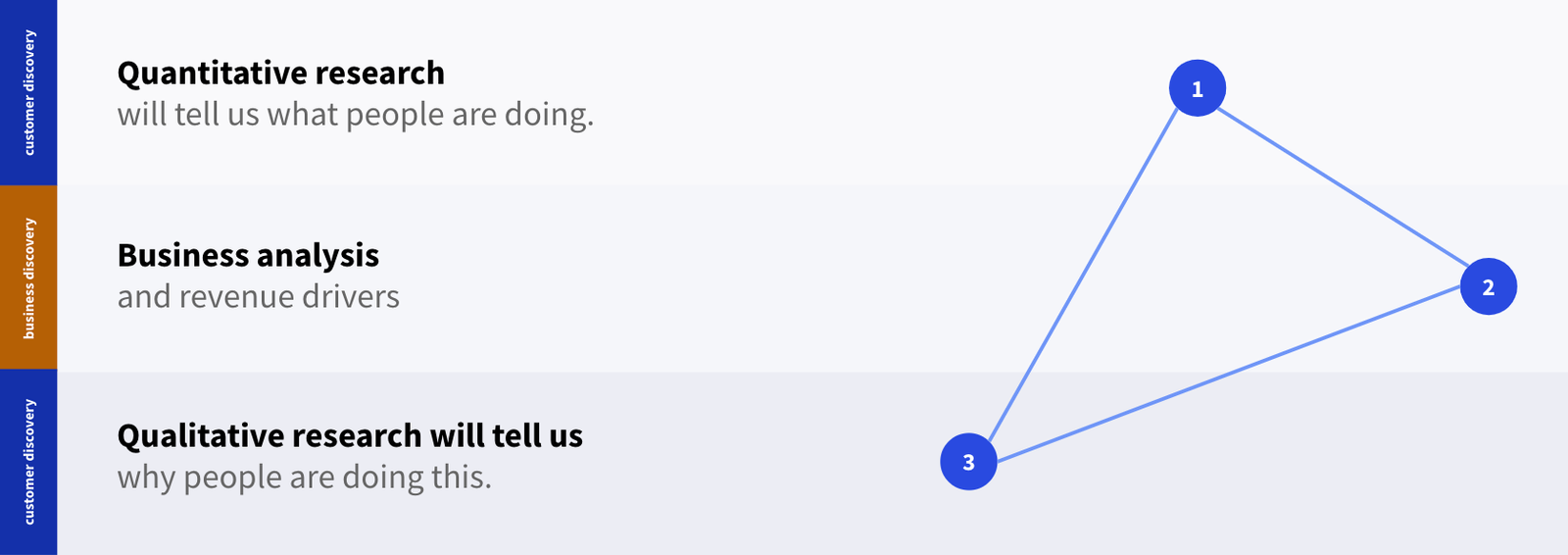

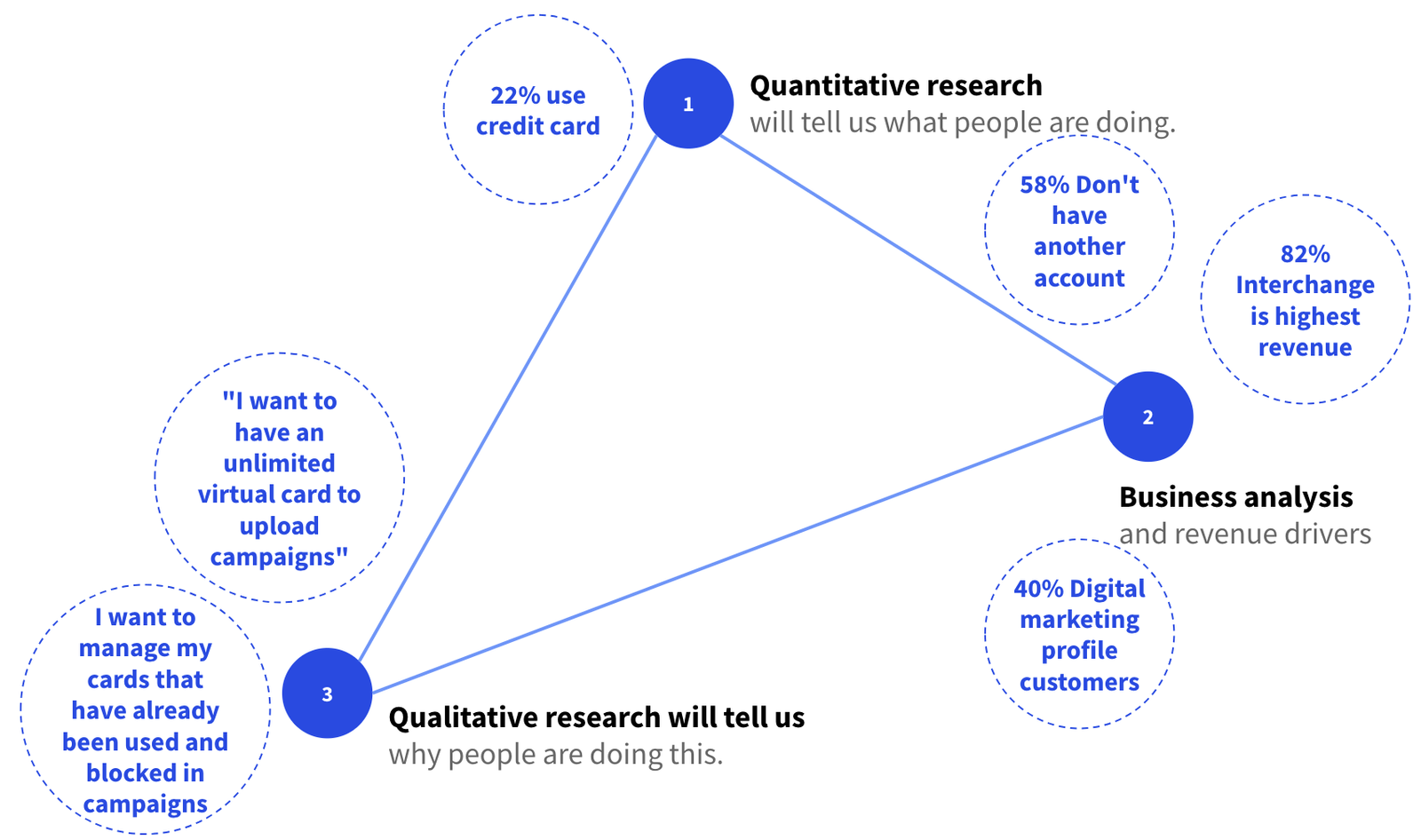

Based on this, we have structured the following strategy:

- Quantitative research will tell us what people are doing.

- Qualitative research will tell us why people are doing this.

- Business analysis and revenue drivers

The best result comes from combining the three types of data.

Search triangulation is like having different camera angles in a movie. It would be difficult to understand the full picture of what is connected in a movie if all the frames were shot in a single perspective.

The objective of quantitative research

Understand how our first customers related to our account (behavior)

As there were few of us in the company, in a meeting, we included the answers that would help us understand the behavior of our customers using the account.

Reason for registering for the Simple Account:

- What is the main reason for the client to open a Simple Account?

- What is most important to our customers in a PJ Account?

Use of products and features:

- How many slips do our customers issue per month?

- How many payments via TED does your company receive per month?

- What is your financial management knowledge? (hypothesis 1)

- What type of credit card do our customers prefer?

- How many limits do our customers need?

- How many physical cards do our customers need?

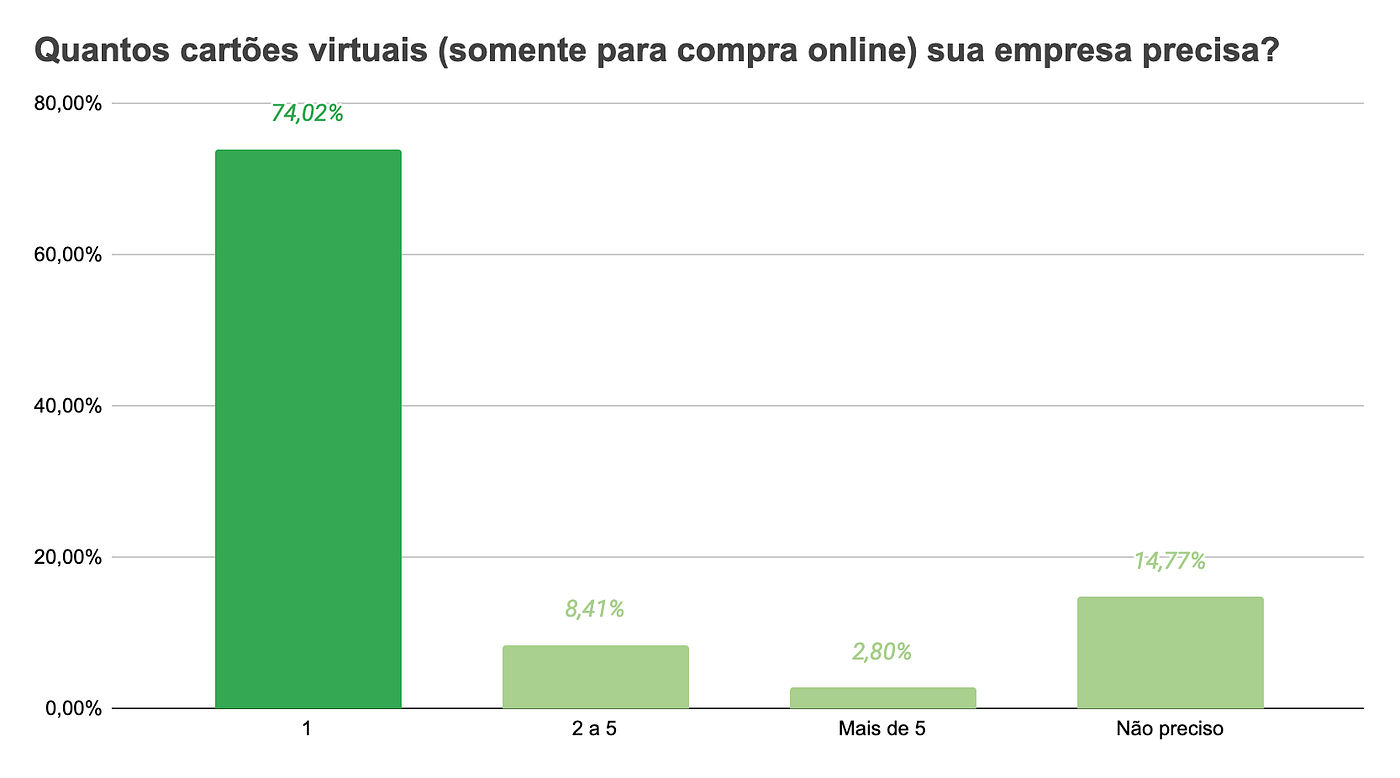

- How many virtual cards (for online purchases only) do our customers need?

Market / Competition:

- Do our customers use another PJ account at a bank? Which?

Who are our customers:

- What do our customers do?

- How much do our customers make monthly?

- How many employees does your company have?

We sent it to the entire base and had 3973 responses. An excellent 56.7% response rate.

Response insights

Why register for the Simple Account?

We understand that a good part of our base needs to use the corporate card. The reason for this is the company’s delay in receiving credit cards from the major banks.

We realized that if this was a pain that the market wasn’t sustaining solving, we explored this audience in more detail.

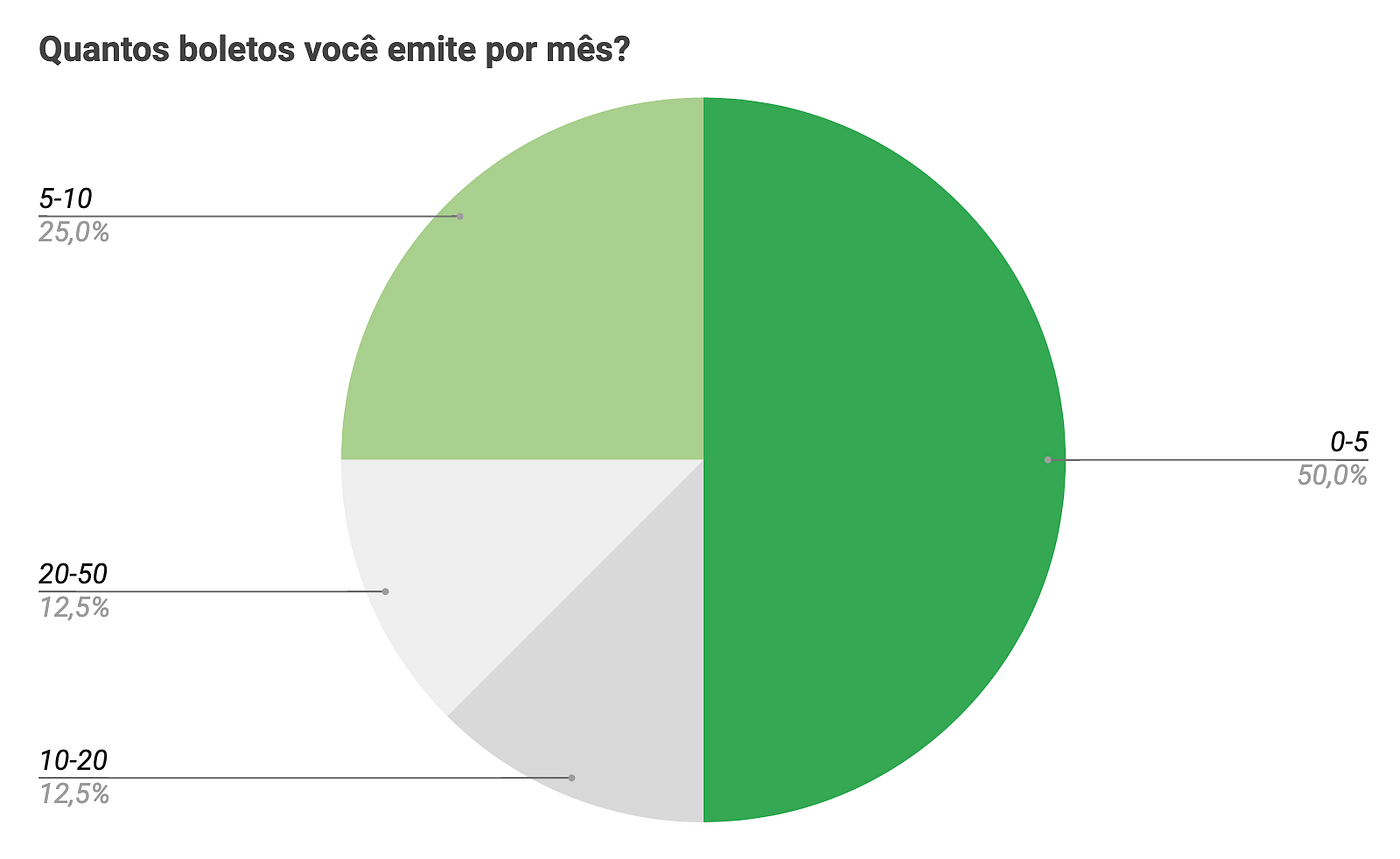

How many slips does your company send per month?

The vast majority of our customers, 75% said they issue between 0 and 10 slips per month. Revenue from paid bills did not have a high margin and, considering the volume, according to the responses, it would not make sense to continue with a solution that was treated for bills.

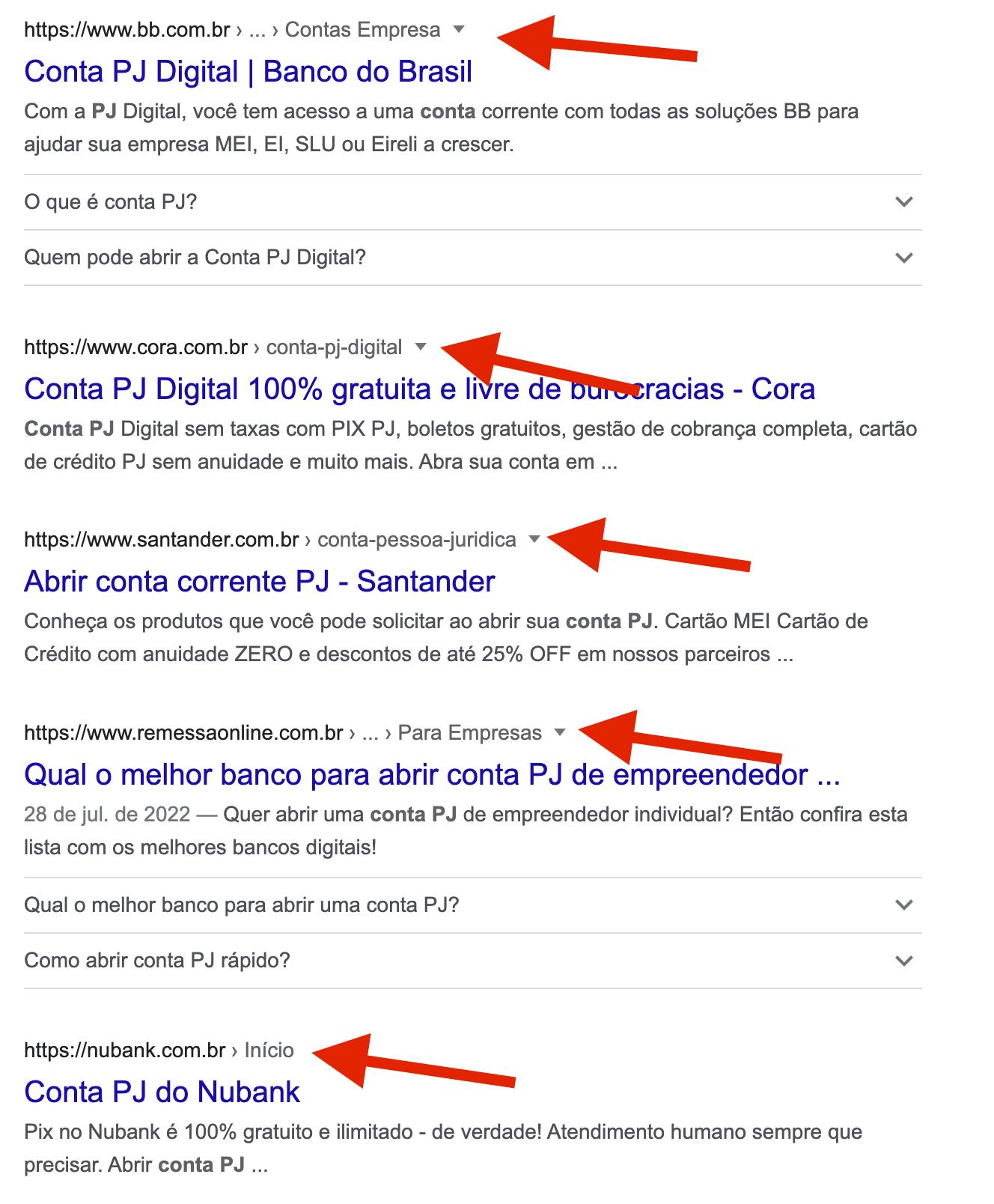

Do you have a PJ Account at any bank?

59% of our customers said they do not have an account at another bank, this being their first experience with a PJ account. Which showed that it was managing to bring in customers who had just opened a CNPJ. However, almost half of our base (41%) said they have relationships with other banks.

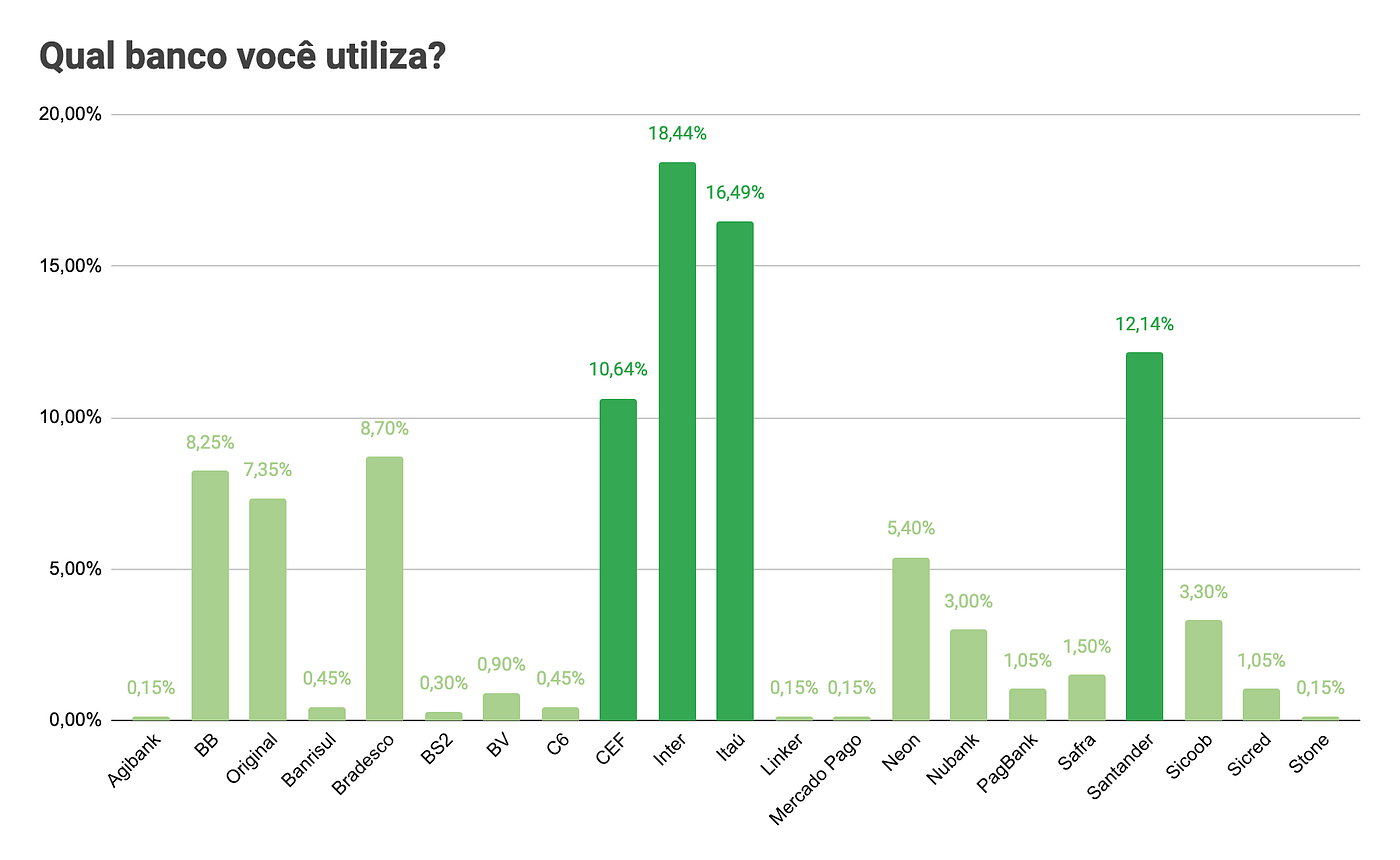

Which bank do you use?

I started filtering the behavior of customers who, for the most part, wanted to use our corporate card (22%) and saw that as a value in opening an account with us.

How many limits would you like on your credit card?

The vast majority of customers did not need such a large limit to get the company’s operations up and running, 42% responded that a credit limit between R$2,000.00 and R$5,000.00 would be enough, and 27% responded that up to BRL 2,000.00.

Which credit card do you prefer?

The great challenge and concern we have with this data are that our credit card was prepaid, and there was practically a strong behavior of customers in wanting a credit limit on their cards, representing more than 80% of customers.

If you don’t get approved in the first few months, would you accept a prepaid card?

55% of customers said they did not want a prepaid card in the absence of a physical card with a credit limit.

How many virtual cards (for online purchase only) does your company need?

And again we have a pattern, the vast majority of customers needed only a virtual card and a physical card to carry out the management and control of the companies.

How many physical cards does your company need?

However, when we started to make different clusters with the database we noticed an interesting fact:

For customers looking to better manage the company’s costs, there was a feature of having larger physical cards.

How many physical cards does your company need? (with filter)

At the end of our survey, we asked if they would agree to talk to us to improve the construction of the product, and with this cluster, we had more than 32% acceptance.

Analytics on business data

At the same time that we were trying to understand the profile of our customers, we also went after the company’s revenue data to understand who were the customer profiles that were generating the most revenue for the company at that time.

Every Digital Account, which is not a Financial Institution (FI), that is, which cannot grant credit, or loans or manage the money in custody, needs to focus its energies on creating a value proposition beyond the account.

In the case of Conta Simples, as we were at the time plugged into a Payment Institution (IP), we had our revenue lines in the use of financial services.

Profile of customers with the highest revenue — by product

In addition, the use of the liquidated bill (9%), and transfer between accounts using the TED modality (7%) also come in second and third place, respectively.

So, by better understanding our revenue lines, we investigated who were the customers that represented the highest volume within Interchange.

Profile of customers with the highest revenue — Segment

And look how interesting this data is, 40% of all Interchange revenue came from the Digital Marketing segment followed by 20% from Startups.

Data crossing

In the text you wrote about the 7 deadly sins of research, I speak of the second sin which is dogmatism, which means the tendency to establish principles as undeniably true, without considering them as proven or as the opinions of others or believing that there is a “right” way to do research.

Triangulação de pesquisa —

So, cross-referencing the data (business with the first qualitative research) we already know that the main feature used by customers with more revenue is the card, but… more questions (now a little more sniper!)

- Why do you like to use the Simple Account card?

- What do we do differently?

- What can we improve?

- What can we do for them to use even more?

We also know that the main audience that generates revenue is MKT Digital companies and Startups, but what we still don’t know is…

- How did these customers come to us? (channel and growth)

- What would make them indicate the Simple Account?

- What are the main pains of the business? Where can we evolve?

And in the quantitative research, we ran (and you saw above) a good part of the customers use the Simple Account to be able to use the physical card (22%) and manage the company’s costs (14%).

- Sniper question: How to improve customer management and boost card usage?

Based on these data and crosses, thinking about our qualitative interview.

Pesquisa qualitativa —

Search with heavy users and that brings more revenue

The objective of this research had 3 focuses:

- Find out why you use the Simple Account

- What would you use more?

- How did you arrive at the Simple Account? (Find the channel to attract more)

We separated interview planning, general questions, product questions, channel questions, and general questions into 3 moments.

General

- How does your business work?

Product

- What made you use the Simple Account?

- What is the main product? Why do you use this product?

- What bothers you the most about this product?

- What do we need to do to be perfect for you?

Channel

- How did you hear about the Simple Account?

What made you open an account? What was the motivation for opening?

Would you indicate? What would you recommend?

Where would we find more customers with your profile? Channel suggestion for us to explore?

In the recruitment process, we were able to schedule with 5 clients.

There is a really cool article by NN/g showing why in qualitative tests you can reach saturation with few interviews. But that amounts to usability testing. There are two cool texts to understand more about how many people to recruit:

Research Facts —

The key to understanding how many interviews would be optimal was — to start small and analyze as you go. Right now we start with 5 companies, which we analyze as we go along. producing many things and in the end, we talked to a total of 8 companies.

Facts, learnings, and research recommendations

Based on the interview, we were able to understand that the majority of customers categorized as Digital Marketing were actually DrogShipping professionals, who sell without stock.

This means that they only work with the intermediation of sales, while inventory management and delivery logistics are carried out by the suppliers of the products you sell.

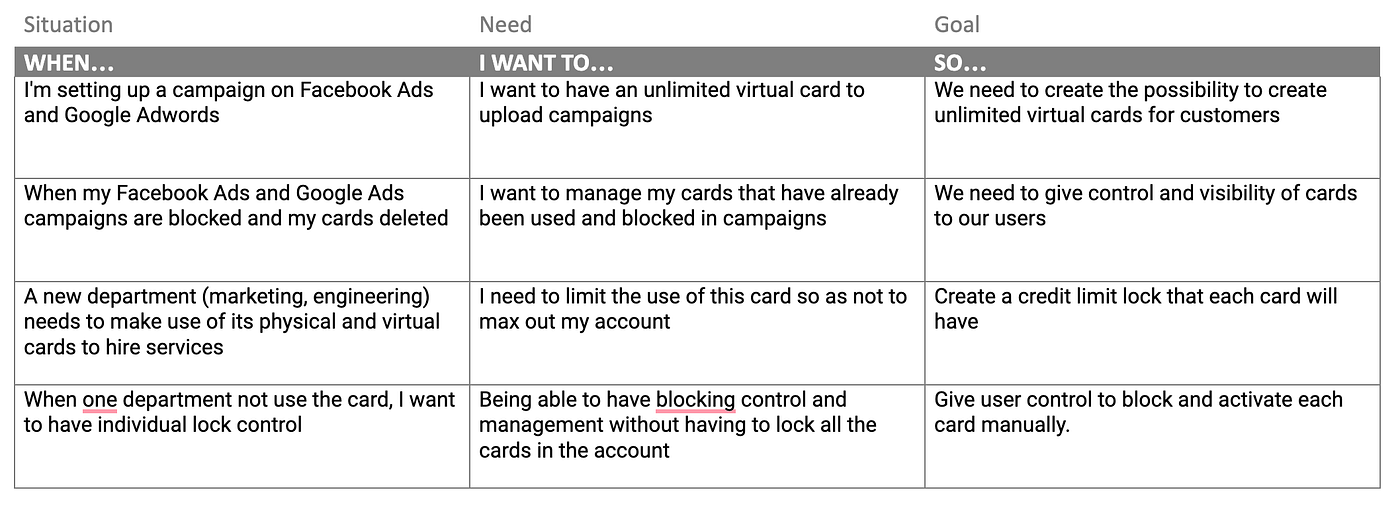

Understanding how this Dropshipping professional works (jobs to be done), made us understand his pain in relation to the credit card.

Most platforms like Facebook/Instagram and TikTok only let you register a card, which can be blocked or deleted by the ad company. So, there was a great need for flexibility in creating different virtual cards for managing online campaigns.

For companies, there was a pain in Google, and Facebook campaigns or in paying for cloud services (Amazon, Atlassian, Slack). And in almost all the interviews, 97% of the participants were using a personal card, until they found the Simple Account.

Another point was in management and control since the personal card mixed PJ account and PF account. Even making this mixture of control between work and personal accounts is also a reason for the mortality of companies in Brazil.

In addition, startups with more than 10 employees had the challenge of controlling corporate cards by company areas, such as marketing, finance, technology, and customer service. Each area needed to control its budget.

Solution —

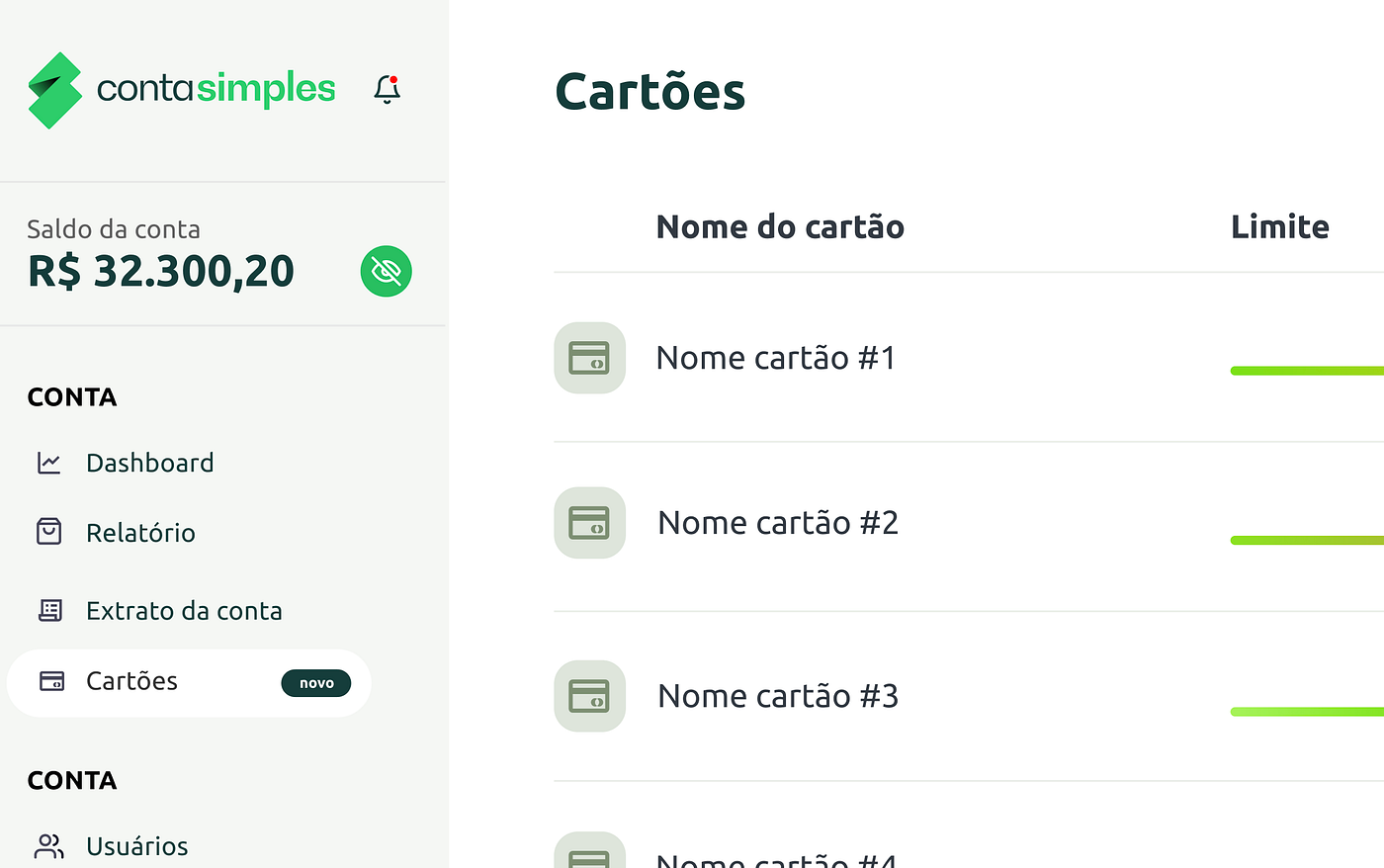

By crossing data between attitudinal, behavioral, and business research, we focused on a corporate card management solution (physical and virtual), with a balance limit per category.

How did your product design improve the situation?

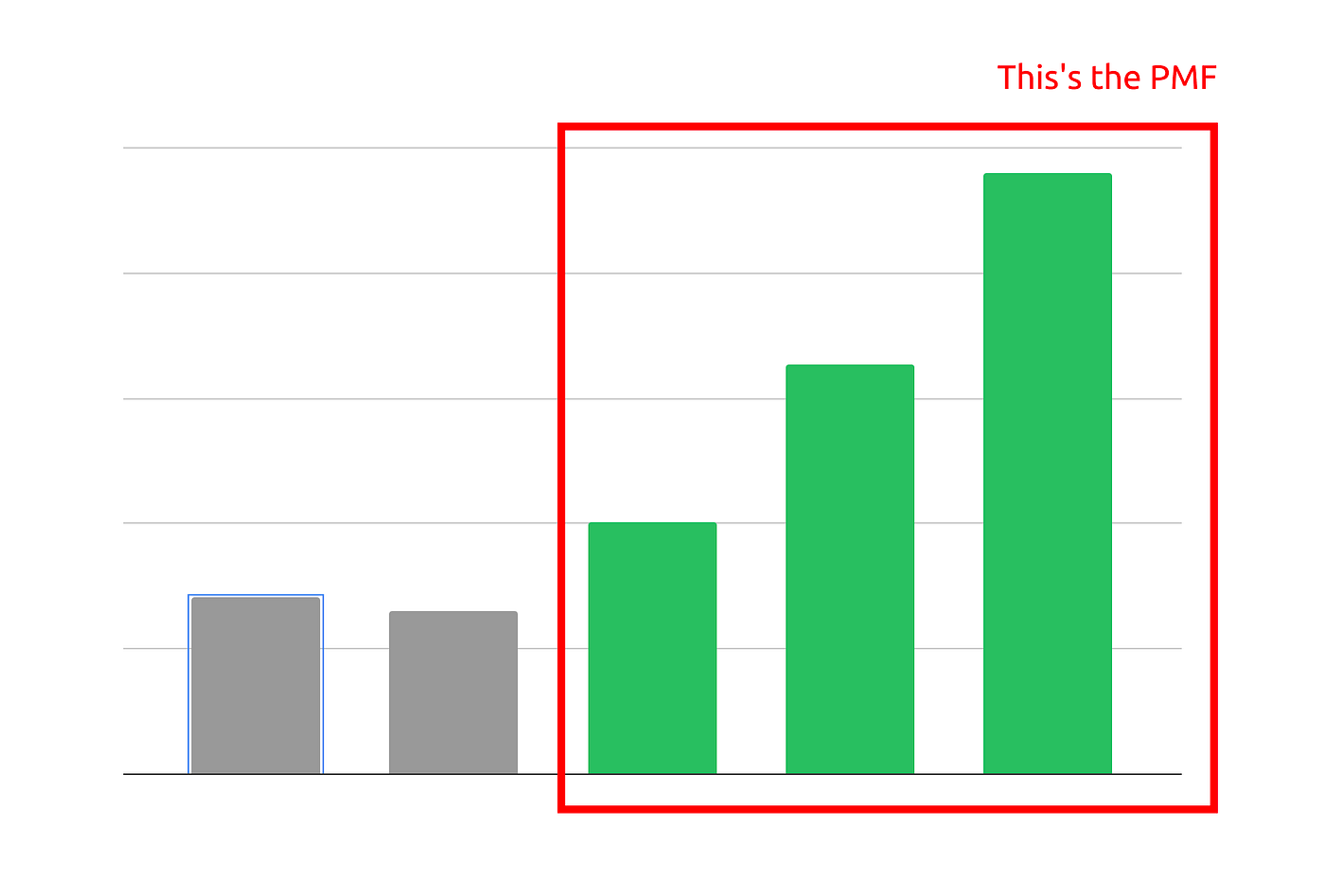

After we uploaded this feature, we found a niche market and started to grow at an average of 20% per week.

Learnings

In a search for 4 weeks with more than 3000 users, we discovered that it is possible to deliver a value proposition in addition to a digital account through the management of corporate cards and that our main focus was digital marketing professionals (dropshipping) and startups.

Discovery

We had several incredible discoveries such as our main audience that generates revenue are MKT Digital companies and Startups. We also didn’t know about revenue levers and that the main feature used by customers with more revenue is the card

What would you do differently?

This was one of the few discoveries that we had the challenge of finding the Product Market Fit for the company in a very short time, in which the future of the company was at stake. This project was, without a doubt, the best project I worked on because it generated a lot of knowledge and learning!